Milk, Dairy and Grain Market Commentary

- Sarina Sharp

- Jun 7, 2024

- 4 min read

By Sarina Sharp, Daily Dairy Report

Milk, Dairy & Grain Markets

The bulls are back in charge on LaSalle Street. July through December Class III and a smattering of Class IV futures notched life-of-contract highs this week. While most Class III contracts ultimately settled a little lower than they did last Friday, Class IV futures added roughly 30ȼ. Third-quarter Class III stands solidly above $20 per cwt., with fourth-quarter contracts in the $19s. Class IV futures are in the $21s and $22s.

Prices moved higher across the board at the CME spot market, led by whey, the unsung hero of the Class III complex. Spot whey powder climbed 5.5ȼ this week – a hefty 13.25% gain – and reached 47ȼ per pound for the first time since February. Spot Cheddar blocks and barrels rallied 3.5ȼ and 1.5ȼ, respectively. That put blocks at $1.845 and barrels at $1.955. Boosted by a strong performance at the Global Dairy Trade auction, CME spot nonfat dry milk (NDM) advanced 2.75ȼ to $1.195. Butter added a fraction of a cent and settled at $3.0925.

While milk output remained below year-ago volumes in April, higher components allowed for greater cheese and butter production. Manufacturers churned out nearly 208 million pounds of butter in April, 5.3% more than in April 2023. That marks the highest butter output ever for the month, aside from April 2020, when pandemic shutdowns pushed nearly all cream to churns. The unprecedented strength in the butter market in the face of sizable output speaks to formidable demand.

U.S. cheese production neared 1.19 billion pounds, up 1.8% from April 2023 and the highest April output on record. Manufacturers cranked out more Mozzarella than ever before, and production of Italian-style cheeses outpaced April 2023 by 6.2%. Strong Mozzarella production is not bearish, as this cheese is typically made to order and either consumed fresh or loaded on ships and moved abroad. It does not typically pile up and drag down cheese prices, as Cheddar is wont to do. In contrast, Cheddar output slumped, falling 8.6% from year-ago volumes. January through April Cheddar output was 5.9% lower than it was in 2023.

Cheese exports remained strong in April, falling just short of the record-setting volumes logged in March. U.S. cheese exports to Mexico reached an all-time high, and shipments to key markets in Asia comfortably outpaced April 2023 volumes. Cheese shipments abroad are up 23% so far this year, which helps to explain why the cheese market briefly topped the $2 mark. But it’s going to be a lot harder to win new business with cheese around $1.90 than it was when cheese hovered around $1.50.

Firm demand for high-protein whey products pushed manufacturers to concentrate more of the whey stream, leaving less for the dryer. After heavy production in the first quarter, whey powder output held steady with year-ago volumes in April. Whey powder exports were also close to year-ago volumes. Nonetheless, manufacturers’ whey powder stocks declined, paving the way for the recent rally.

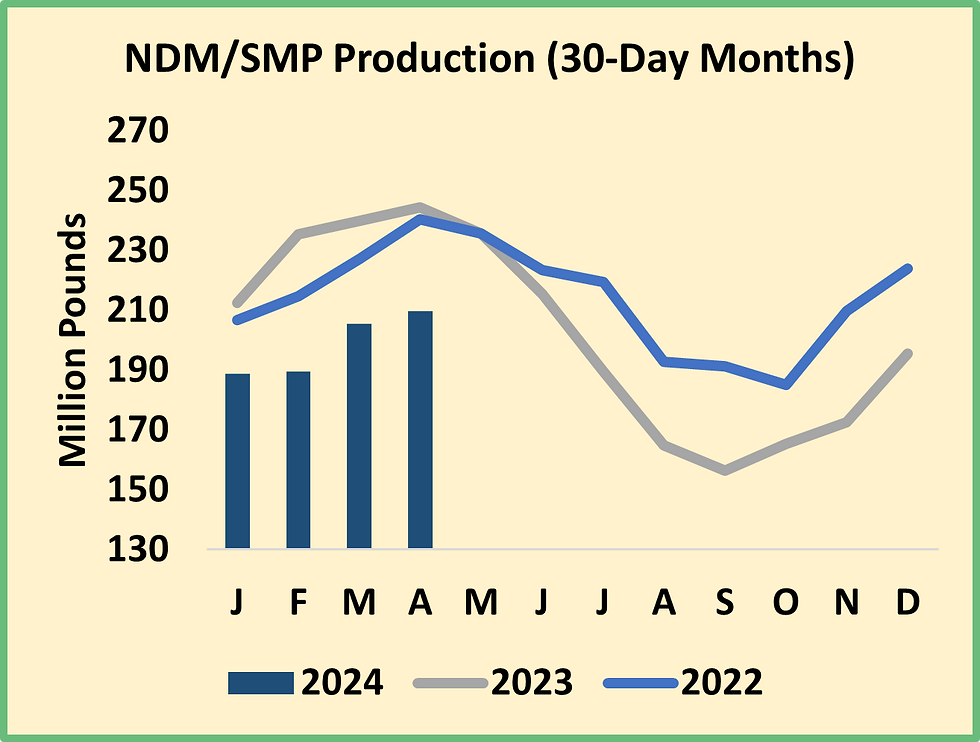

Lower milk output and greater cheese production reduced the lineup of trucks waiting at the dryer. Combined production of NDM and skim milk powder (SMP) totaled 209.6 million pounds, down 14.2% from the year before and the lowest April milk powder output since 2013. Nonetheless, NDM stocks surged, logging their largest March-to-April increase ever. Slower exports are likely to blame. The U.S. sent 144 million pounds of NDM and SMP abroad in April, 2.5% less than the year before and the lowest tally for the month since 2019. But it’s possible that export volumes may soon improve. Higher cheese prices could entice Mexico to import less cheese and more NDM, which manufacturers there can use to fortify their domestic cheese production.

The dairy markets promise producers a much more prosperous future. But the mixed signals from this week’s data and the extreme volatility in the dairy complex counsel caution. There are many barriers to expansion – including high interest rates, scarce heifers, and the bird flu – that suggest milk production will not grow quickly. But Class III futures are $3.50 higher than they were a year ago, and corn is $1.55 cheaper. Dairy producers have a powerful incentive to make more milk, and they will likely succeed. They also have an excellent opportunity to protect today’s margins using futures, options, or the Dairy Revenue Protection (DRP) insurance program.

Grain Markets

The feed markets swayed back and forth this week but finished near where they began. July corn closed at $4.4875, up 2.5ȼ. July soybean meal fell $4.10 to $360.60 per ton. Farmers have almost finished planting their crops, and a drier forecast should allow them to sow their final acres. While heavy spring rains created a lot of mud and headaches, concerns about lost acres have been put to rest, and most farmers will be grateful for much-improved moisture reserves to carry them deep into summer. Less ideal conditions in other farming regions around the world could boost U.S. export prospects, which will prevent prices from dropping too far, too fast. But, assuming normal weather, the U.S. is likely to harvest large crops, and feed costs could drift even lower than they are today.

Comentários